Successful bank managers use critical thinking to plan their business and identify growth opportunities

With the increasing use of online and mobile banking, bank managers are less likely to see walk-in clients than before. Clients are also less likely to stay loyal in today’s competitive financial services space. Managers and staff now have a greater need to adopt an entrepreneurial and business owner mindset. Evaluating the environment, allocating resources effectively and moving business forward to meet growth targets are imperative to daily operations. Success is driven by understanding your business, creating a strategic vision and mapping out a set of objectives to bring you there. The Business Development Planning – Bank Management course prepares you to meet these challenges.

Business Development Planning – Bank Management teaches you how to analyze your business environment, from the branch or head office perspective, to discover business opportunities. You will learn how create marketing and sales strategies to take advantage of those opportunities, and you will learn how to make the best use of the tools and techniques available to execute your business plan. You will also improve your critical-thinking skills and leverage resources to drive performance. After completing this course and business plan, you’ll have a detailed document that will immediately improve your branch or department by guiding business decisions and providing proactive support for your clients and colleagues.

Benefits

Business Development Planning – Bank Management provides a comprehensive understanding of:

- The business owner mindset and the importance of critical thinking in planning, managing and create opportunities to grow business.

- Business strategy

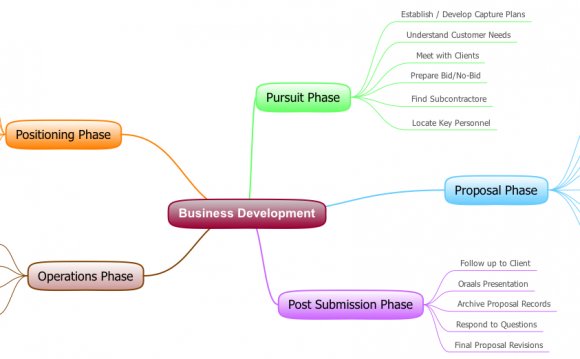

- Proactive planning and business development methodology

- Market segmentation and the effect on your businesses bottom line

Benefits

Who should enrol?Business Development Planning – Bank Management is designed to address the unique challenges of business development in banking and will benefit existing and new managers to banking, unit managers, team leaders, account managers seeking greater responsibilities and career growth opportunities, banking specialists and individuals working in support capacities in the industry.

This course features a proctored exam and is ideal for individuals working in banking who have direct contact with clients and bank employees with leadership responsibilities or objectives. It will enhance and build your existing management skills allowing you to excel in positions like branch manager, specialist managers, call centre managers and managers of internal services and other support roles.

INTERESTING VIDEO