Thinking of Starting Your Own Tax Business?

Add the Business Start-Up Guides: For only $100 more, you’ll get the following guides to help you start your own tax business…

Guide to Starting a Tax Business & Getting Clients Guide to Policies & Procedures for a Tax BusinessCompletion of one of our certificate programs at The Income Tax School (ITS) will enhance your reputation as a trusted tax professional and give you a competitive advantage in your market. Plus, your increased knowledge will enable you to:

Prepare more complicated tax returns Increase your revenue by charging higher fees for more complex tax returns Acquire the knowledge necessary to prepare for the EA exam, and more!These nationally recognized tax certificate programs enable you to start preparing individual tax returns for most U.S. taxpayers after successfully completing the first course in the program!

The Chartered Tax Certificate Programs are unique because you have the opportunity to earn money as a tax professional while you study, and to also internalize the knowledge by applying what you learn. With the talk of more requirements for tax preparers, many have decided to work towards becoming an IRS Enrolled Agent (EA), the most distinguished credential in the tax industry. The Chartered Tax Certificate Programs are the perfect stepping stones to becoming an EA!

No prior tax or accounting knowledge is required and minimal computer skills are needed. Students should have a high school diploma or the equivalent, the ability to comprehend the income tax regulations, and good people skills to interact effectively with taxpayers.

2 Easy Steps to earn a Chartered Tax Credential:

Step 1 Successfully complete The Income Tax School courses required in any of the three Chartered Tax Certificate Programs.An average grade of at least 80% must be attained. Our students average 90%+. Step 2 Meet the experience requirement for your selected certificate program.

After completing the first tax course, you’ll have the tax knowledge to prepare individual tax returns for almost all U.S. taxpayers and you can start working towards your experience requirement. Plus, you’ll start earning money! Prior tax preparation experience will count for experienced tax professionals who test out of the Comprehensive Tax Course.

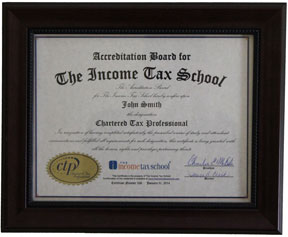

Chartered Tax Professional

As a Chartered Tax Professional, you will be able to handle very involved individual tax situations as well as tax returns for small business corporations, partnerships and more complex sole proprietorships. The CTP® certificate program covers both basic and complex individual Form 1040 and small business corporation Form 1120 & 1120S and partnership Form 1065 tax returns. These more complicated tax returns will open up new, more lucrative markets for you. Becoming a Chartered Tax Professional (CTP®) can significantly enhance your salary and your advancement potential as a tax professional, and can be completed in 18 months or less!

If you’re committed to becoming a tax professional, you should definitely consider the CTP® program. Put your education toward a certificate that prepares you for the highest designation in the tax industry, the Enrolled Agent (EA)! As a CTP®, you will have the tax knowledge and experience to prepare for the IRS Enrolled Agent (EA) exam, if you wish to add the desirable EA credential to your professional designation as a CTP®. Upon completion of the CTP® program, you can take an EA exam review and then sit for the EA exam. This will put you at the top of the tax professional field in under 2 years!

If you’re a CPA, CFP, attorney, or if you hold some other professional license, you may be able to satisfy some or all of your continuing education requirements through your coursework in the CTP® program. Tax knowledge is valuable to many professionals because financial decisions usually involve tax consequences for their clients. Providing tax preparation services is also a great way to diversify and recruit new financial services clients.

Courses included in this program:

Additional Requirements:

Annual CE requirement beginning the year after you qualify as a CTP® 15 Hours (9 hours federal tax law, 3 hours ethics, 3 hours federal tax law updates) Experience requirement: 500 Hours must be completed before final CTP® certificate is issued.Learn more about the CTP and Enroll:

Chartered Tax Consultant

The Chartered Tax Consultant (CTC) certificate program will enable you to prepare both individual Form 1040 and small business corporation Form 1120 & 1120S and partnership Form 1065 tax returns. No prior tax or accounting knowledge is required and minimal computer skills. Students should have a high school diploma or the equivalent, the ability to comprehend the income tax regulations, and good people skills to interact effectively with taxpayers.

Courses included in this program:

Annual CE requirement beginning the year after you qualify as a CTC: 15 Hours (9 hours federal tax law, 3 hours ethics, 3 hours federal tax law updates) Experience requirement: 100 Hours must be completed before final CTC certificate is issued.Chartered Tax Advisor

The Chartered Tax Advisor (CTA) certificate program will enable you to learn to prepare most individual Form 1040 tax returns, including more complex situations. No prior tax or accounting knowledge is required and minimal computer skills. Students should have a high school diploma or the equivalent, the ability to comprehend the income tax regulations and good people skills to interact effectively with taxpayers.

Annual CE requirement beginning with the year after you qualify as a CTA: 15 Hours (9 hours federal tax law, 3 hours ethics, 3 hours federal tax law updates) Experience requirement: 100 Hours must be completed before final CTA certificate is issued.Your Chartered Tax Designation Can Be Earned in Months

All Chartered Tax Certificate courses are online and can be completed anywhere, anytime-24/7. The affordable tuition includes instructor support, plus a hard copy of each tax course student books at no additional cost. The first course, Comprehensive Tax Course, consists of twenty 3-hour lessons, which can be completed in just 10 weeks when you complete two lessons a week. Each remaining tax course consists of ten 3-hour lessons and can be completed in 5-10 weeks (one or two lessons per week). The CTA® and CTC® programs can be completed in less than four months, but you are given up to 12 months. While the CTP® program can be completed in less than eight months, but you are given up to 18 months. During this time you can also be working, earning money and gaining experience as a tax professional.You will be awarded a Chartered Tax Certificate

A Certificate of Completion with your credit hours will be awarded for the successful completion of each course in the program. Once you complete the entire certificate program (successful course completion and experience requirement), you will be awarded a very impressive Chartered Tax Certificate and the designation of Chartered Tax Advisor – CTA®, Chartered Tax Consultant – CTC®, or Chartered Tax Professional – CTP®.

INTERESTING VIDEO